Making a Collection

A comprehensive guide for building an effortless user experience to enable you to receive local fiat from your customers.

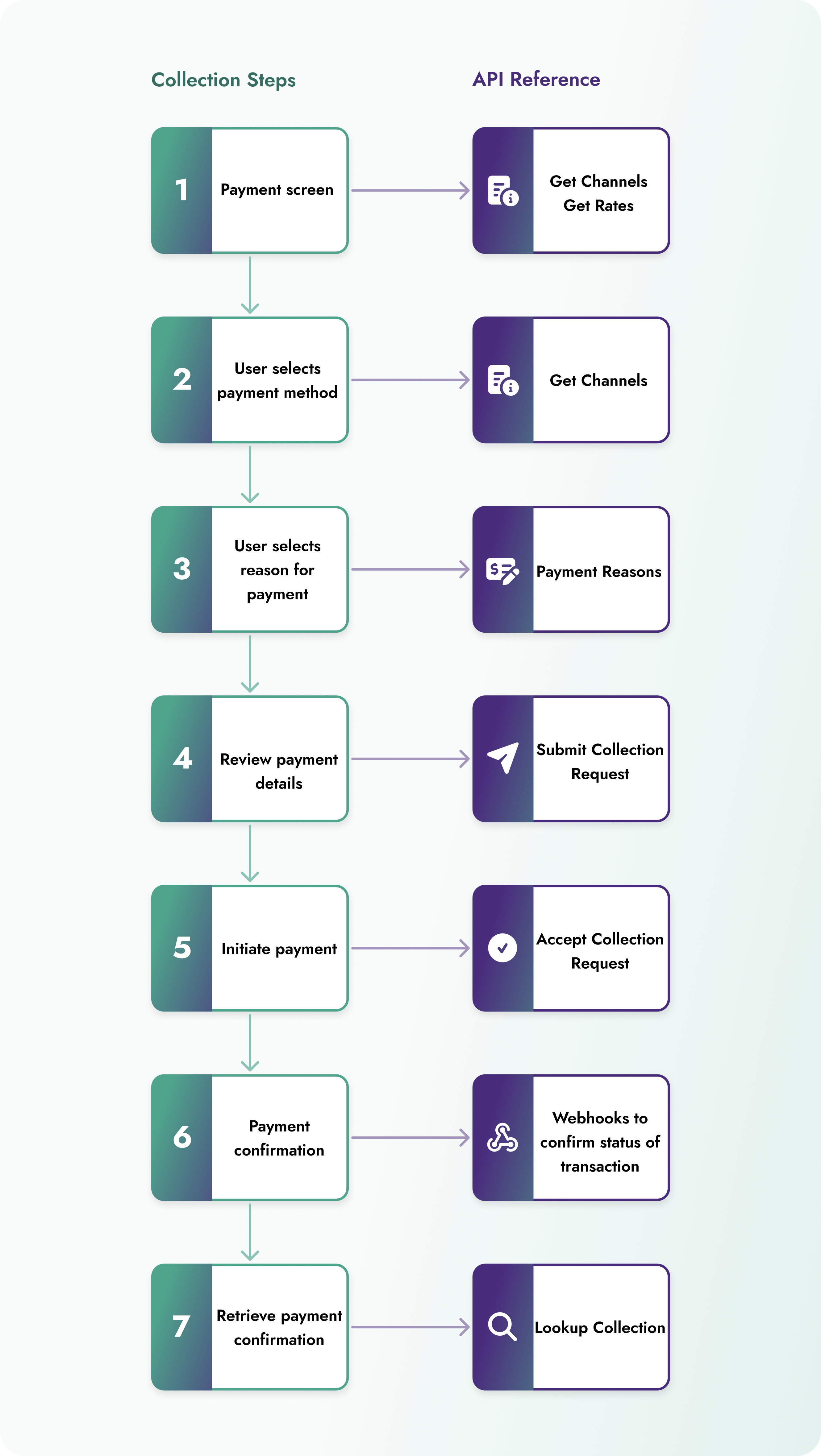

Collection Steps & API Overview

A user journey guide for collecting fiat from your customers, including the API reference at each step.

User journey step | What to show on the UX | What to ask the user for | API reference | What's returned from the API |

|---|---|---|---|---|

| A place for the user to view the amount to pay | n/a |

|

|

| List of payment channels available to them eg: Bank Transfer, Mobile Money, P2P transfer | Their preference of payment method | A list of available payment options for the given country | |

| Input fields for customer to enter beneficiary details:

| Please add mobile money details: | Mobile provider = Get Networks | A list of available networks |

| Ask the user the reason for their transaction | To choose from a list of reasons | Reason for sending = Payment Reasons | Pre-defined list of reasons to select. |

| Transaction details including:

| To confirm the payment. | A quote to make the collection | |

| Confirmation the transaction is being processed | n/a | Confirmation or rejection of the transaction | |

| Confirmation that payment was successful. | n/a | n/a | n/a |

| View of transaction details | View transaction details | Information about a specific payment |

To get started, open the recipe below:

Updated 3 months ago